Covid 19 Real Estate

Who Will Be The Covid 19 Winners And Who Will Be The Losers?

Surprisingly, some large real estate chains are trying to sugarcoat the effects of the Covid 19 crisis on the international real estate market. Indeed, some of them are quite shocking in their attempts to shore up their huge overheads. One even talks about a rise in sales due to their excellent “virtual” sales team and implies that customers are at their computers readily placing offers after “virtual tours”. Others; are a tad more candid, admit that things are pretty bad at present, but report that the last quarter will see an uptrend and we will all be ‘happy ever real-estate after’ in 2021.

The truth is that no one knows what will happen to the real estate market. No one yet knows the real economic cost of Covid 19. So anyone who tries to reassure the owner that their property is still anything like its pre-Covid 19 worth is doing so for their own business benefit.

First Motto - Hang On

If you can afford to hold on to your property. Do so!

Second Motto - Fire Sale

If you can not afford to hold on to your property. Reduce your asking price by 30% and you should be able to sell it.

Third Motto - Pass On The Hit

If you want to upgrade from your existing property, then you still can do so. Simply take a 30% hit on your current property and pass on the hit in the form of a reduced offer on your new property. Price reductions are like kinetic energy - there are no buffers!

Fourth Motto - Death & Disaster

This is the most tragic part of the Covid 19 crisis, but any realtor will tell you that their business liquidity relies on the four D’s. Death. Divorce. Debt & Disaster. Covid; alas is no different, and presents an opportunity. Death will result in a wave of “estate” sales. Executors tasked with the act of closing a deceased estate. The negotiating attitude of an executor is very different to that of an owner. Executors are under pressure from beneficiaries and the tax man to close estates and divide up the assets. More often than not, they are not beneficiaries themselves. So they are far more likely to negotiate on deals as the loss of 30% is merely only felt by the tax man and not themselves. So if you are thinking of upgrading, then going for an ‘estate” sale is a very sensible option.

Fifth Moto - Buy Properties that Cost the Least to Run Or Indeed Pay You To Own It

If you are keen to go ahead with an investment property purchase - either as leisure or residential. Go for the property that comes with guaranteed rental returns and NO EXPENSIVE SERVICE charges. Do not purchase units that are leasehold over which you have no control over the charges. If it is residential property, only choose units that suitably close to a reliable working metropolis as these units will stand more chance much earlier of showing signs of recovery. In order to cover yourself in tenant hard times, choose a tenant in full time employment and then make them a time limited contractual offer that for the first 12 months they only pay the service and utility charges for the unit. After that they pay the full rent. This will get you the best tenants onward going.

Sixth Motto – Finally Avoid High Taxing EU Locations. It will only Get Worse & Check Airline Dependence

The Covid 19 crisis will prove to be a financial bombshell for already struggling EU economies. Notably, Spain, Greece, France and Italy. Wealthy foreign property owners will be an easy target for revenue desperate governments. So look at non- EU locations that are not too far from Europe. These are the UK, Channel Islands, Montenegro, Andorra, Egypt and Turkey. Also be careful in Europe to check that airlines are still going to offer pre Covid routes and schedules. Many airlines are going to go the wall or cut routes. Given the fact that the close proximity of reliable air links can make up to nearly 30% o the value of a property. This latter issue is vital.

Should you require any further Covid 19 property advice either as a buyer or a seller. Please contact MEPM Director Edward Hill on WhatsApp +44 7765 617209 or via email ehill@mepm-property.com

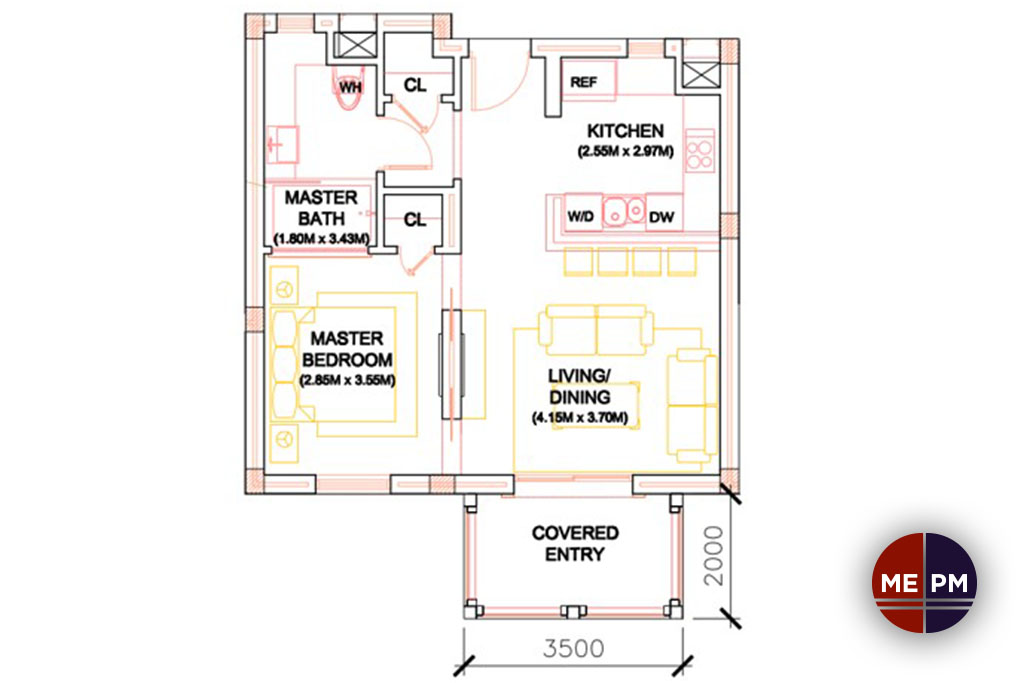

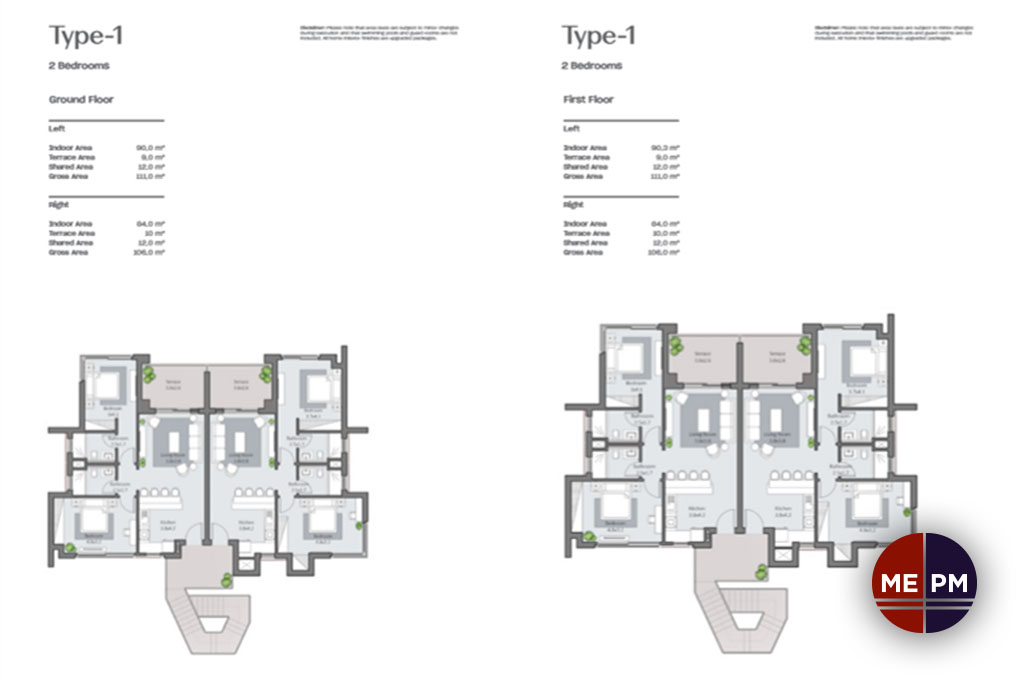

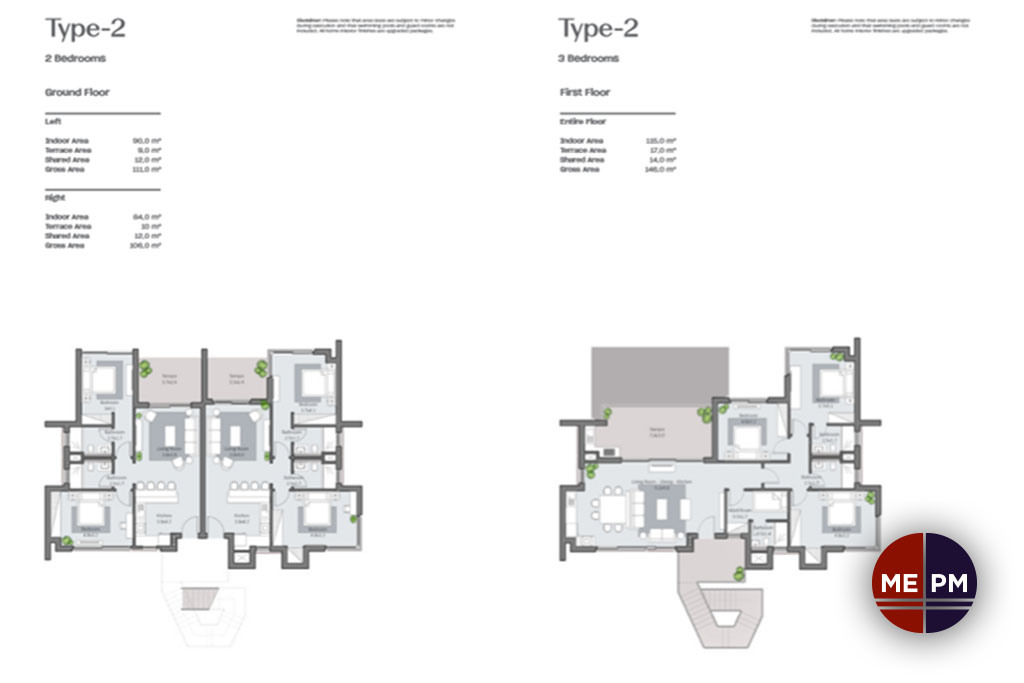

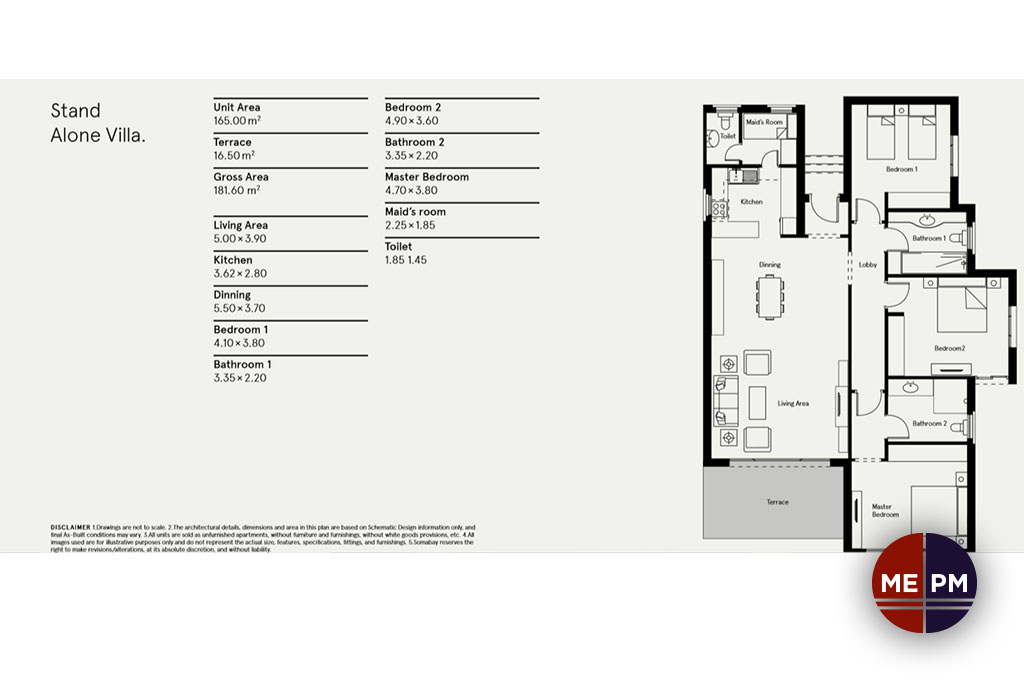

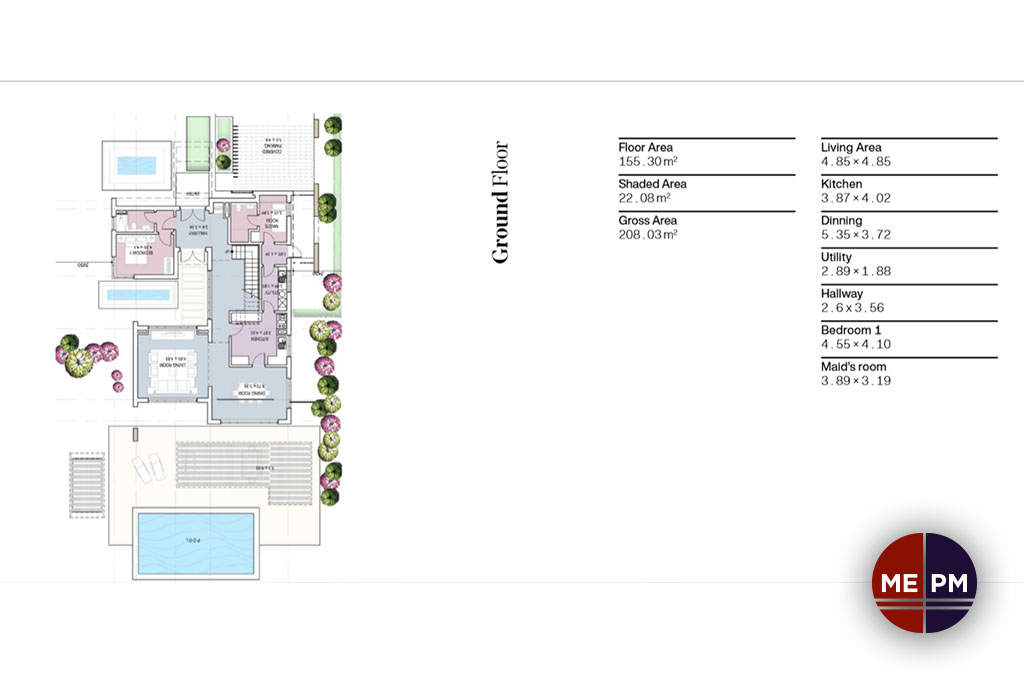

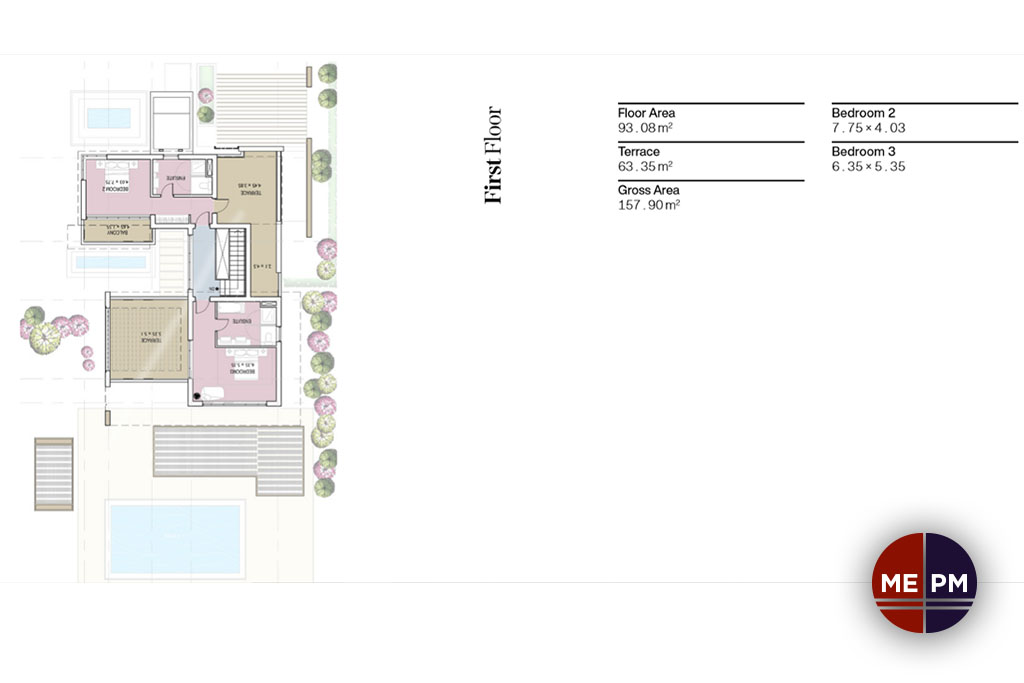

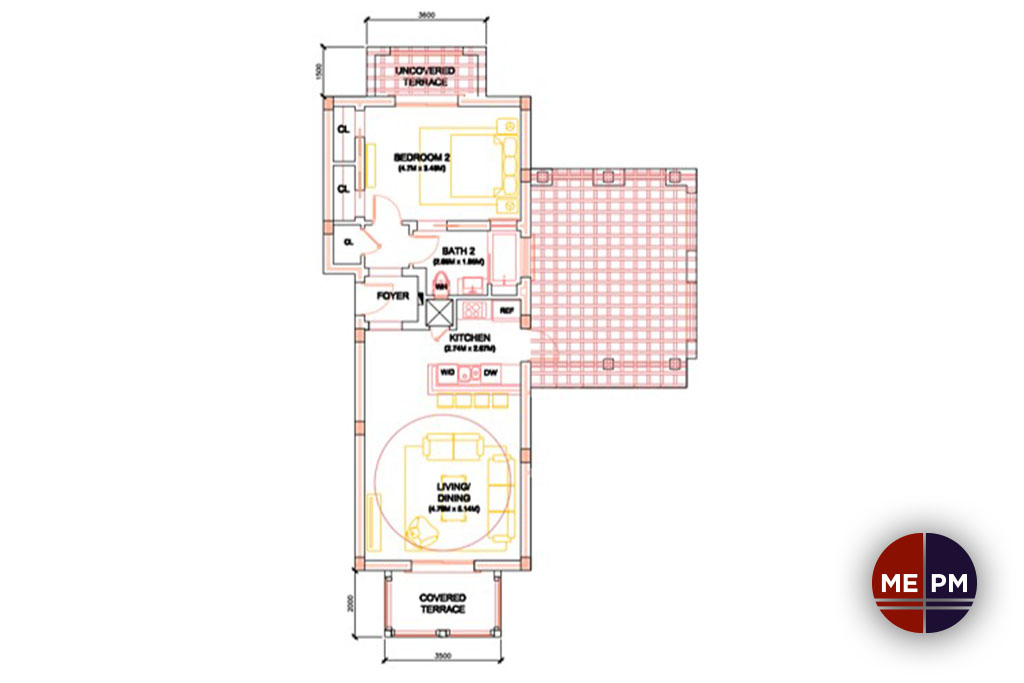

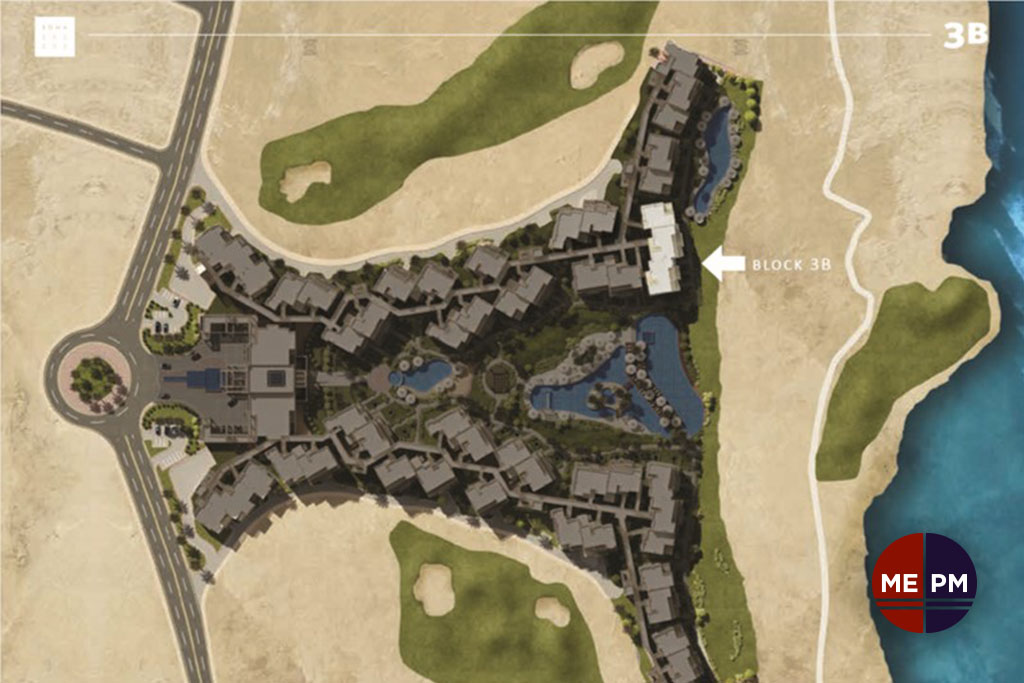

Take a look at the some of the Covid property on offer with MEPM.

- Listing ID

- Built up Area

- Price

- Bedrooms

- Pictures

- Add date

- Featured

- View

- Country

- Steam

- Title