Estate Agency Secrets: How to Understand Rental Potential

When buying a home overseas a huge proportion of people want to rent it out to either holiday makers or to long term tenants. We never recommend basing a purchase solely on rental potential but it can help ease the ownership costs. That being said, sometimes even the best rental properties can suffer from a bit of bad luck, so any buy-to-let owner always needs a back-up plan and rental insurance to make sure that their ongoing costs are covered and to minimise their risk.

1. Understand the Rental Demand

Rental demand for properties overseas comes from one of two places, residents or tourists. In many tourist locations both markets exist, but you must choose between the opportunities.

Typically, the residents will rent long term (contracts in excess of 6 months) but the price per night will be lower as a result. Conversely, tourists will usually pay higher rates for shorter durations. You need to understand what the demand is based on and then establish if your property and pricing fits with that demand.

2. Get Real Rental Prices

Don’t just rely on what your real estate agent or the property developer tells you about rental prices. You need to find out for yourself the rental prices that are actually being achieved – and no this isn’t what is listed as the hotel rack rates! Often it is not what is listed on holiday rental or estate agent websites either!

Booking.com and other price comparison sites give a good indication of the no frills option for hotels in the area as their contracts obligate hotels to provide them with the best online deal. But don’t forget, advance bookings and groups are treated differently. For home rentals, you should assume that the actual achieved rental is circa 10-15% below that for which it is marketed (if lets are a minimum of 7 nights). Don’t forget to factor in empty periods and price variations for off and on peak.

For long term rentals, it is usually fair to assume that the final renting price will end up 5% either side of the listing price subject to real demand.

3. Understand the Touristic Demand & Occupancy

If you have decided to do a holiday let rather than a long term let for residents, you will need to understand the tourist market in the area you are buying.

You also need to understand the factors driving tourism to the area. Is it owing to currently cheap travel? Is it a result of many charter routes and what would the impact be if one or some of the charter routes were cancelled? Is the tourist board investing heavily in attracting tourists? Is it a bad year for weather in other destinations? Not every year will be exactly the same, so identify the current trends and consider what might change and the impact that it may have.

Occupancy is a major factor in determining rental potential for holiday lets and occupancy for holidays. You need to understand when peak and off peak seasons are and the sort of volume you can expect.

You should talk to the reception personnel in the nearby hotels, they will often share with you their occupancy if you ask with a smile and give you a decent indication of the tourist seasonality. Remember that hotel occupancy and rental occupancy are not the same things. But during peak periods, rental properties are likely to benefit from overflow from any full hotels. For holiday lets you should take a look at sites like www.airbnb.com and www.homeaway.com to see the sort of prices people have listed their properties for during different seasons. This should help give you an indication of what to expect. You should also talk to specialist vacation rental firm who really understand the market.

4. Check stock absorption

When buying a property as a vacation or long term rental you need to know that there is a market and that it isn’t going to just lay empty. Imagine that you have decided to buy a short-term vacation rental. If there are 100 properties on the market but only 10 tourists 50% of the time and there are three large hotels, then you need to assess if the property has the rental opportunity that you think based on the real number of tourists coming to the destination.

Similarly, imagine that there are 100 residents who need rental accommodation and 120 1 bed apartments to accommodate them. This means that 20 of those properties will be empty if there is no wider market to approach. You can always compete on price or expand the reach if there is a genuine reason for people to want to live in the area, but you need to have factored this into your purchase calculations and remember that as a result the property may not always be occupied.

5. Know Your Fixed & Rental Based Costs

You should make sure that you have a full understanding of your fixed costs and any taxes that apply to your ownership. This includes your mortgage repayments (if any), maintenance fees, service charges, ownership taxes and so on. You should be aiming for your rental income to cover these costs as if it doesn’t, the purpose of having a rental property is negated.

You should also understand the additional costs during rental periods, such as additional utilities, tax on rental income (if applicable) and agent’s commissions to make sure that you can factor them into your pricing calculations. These costs should also be covered by your rental income.

6. Using your property on peak. Did you want to use your property at New Year?

Many people buy a holiday let in the belief that they will generate an income from it and also enjoy their holidays there. The thing that they often forget is that the best income is generated during the peak holiday periods and that’s when they also want to use it. We highly recommend that if the rental income is the most important thing on your investment hit list that you avoid use during peak periods, or at least divide your visits between off and on peak to try and minimise rental losses.

Buying a holiday property as a buy to let investment can be an exciting way to generate some income and to cover the ownership costs of a property. The key is to truly understand the rental opportunity and to make your own projections for probable income as well as creating a contingency plan in case the property doesn’t let or for example, there is a major maintenance issue preventing it from being let.

In a nutshell, the key is to have covered your up-side, your down-side and to have made a genuine plan for how you will manage your property making sure that you really understand every element of what is involved in owning a vacation rental. Additionally, if your aim is to only cover part of the cost and what you are really interested in is owning a home overseas for your enjoyment, then this changes the parameters. If you are going to struggle to pay for the ownership costs if the rentals are not successful this also changes the parameters. You have to make the property work for you.

MEPM can help you find excellent vacation rental homes so that when you make your projections you will be smiling based on your needs.

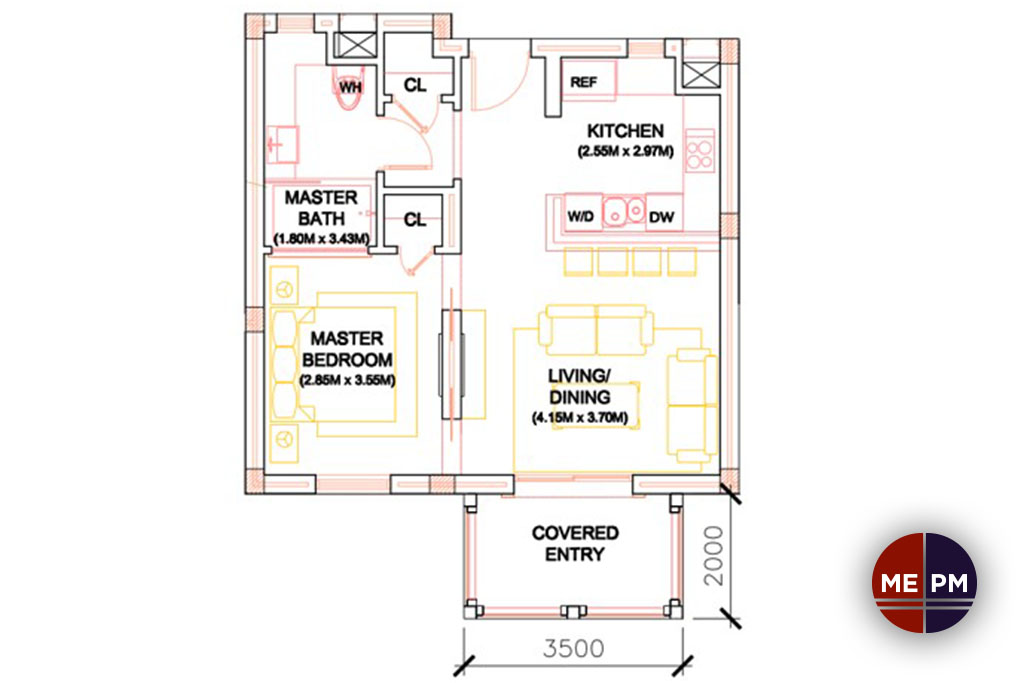

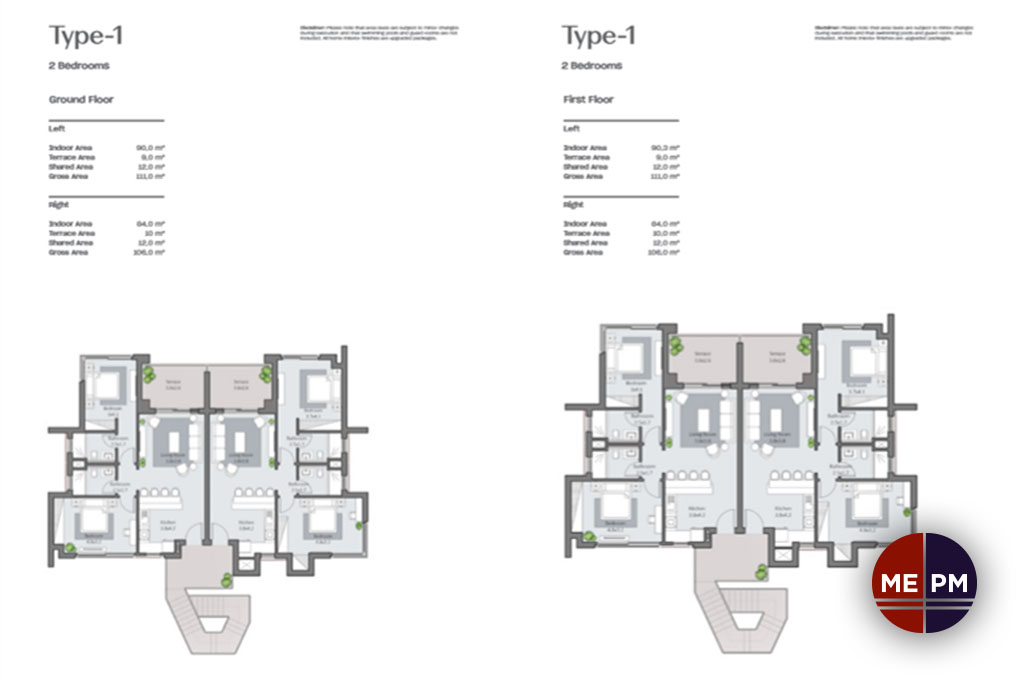

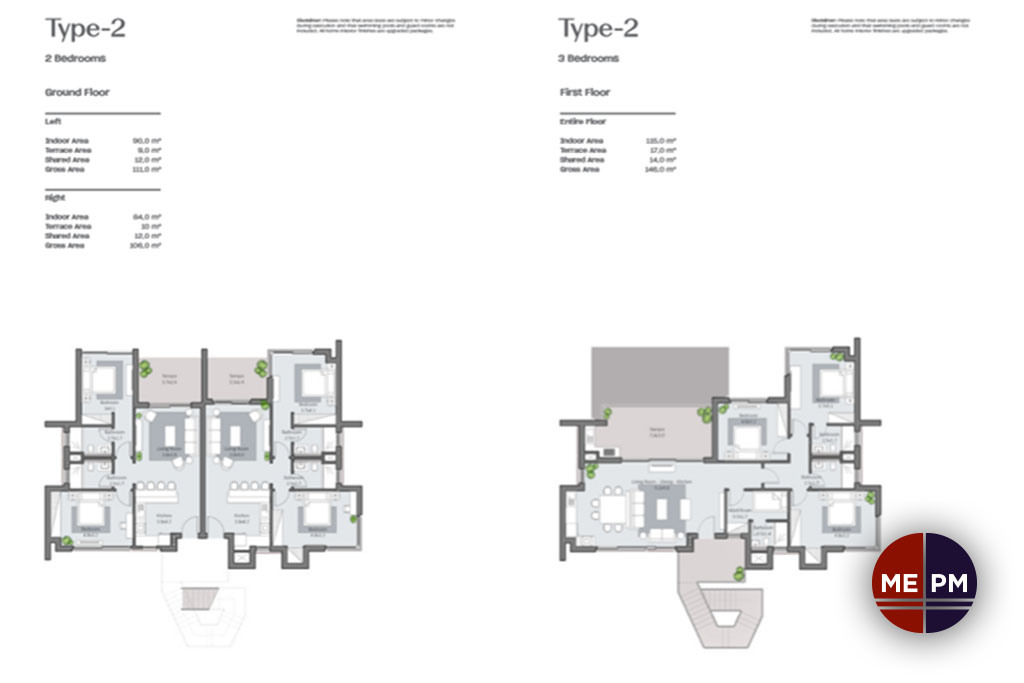

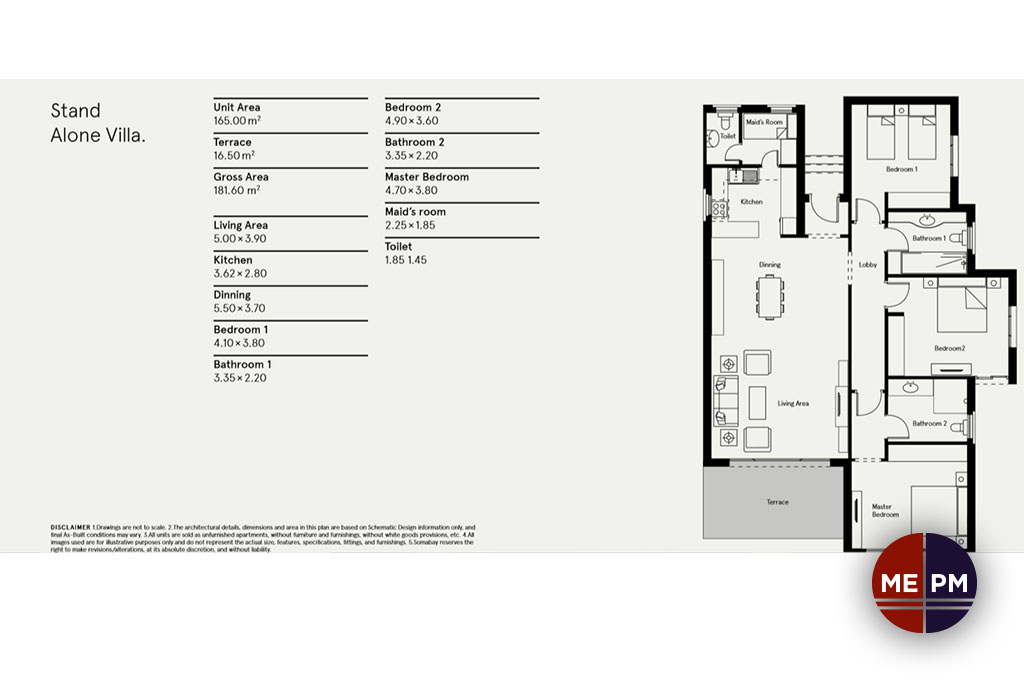

Find your perfect buy-to-let vacation home.....

- Listing ID

- Built up Area

- Price

- Bedrooms

- Pictures

- Add date

- Featured

- View

- Country

- Steam

- Title